The Flight to U.S. Treasuries

Introduction

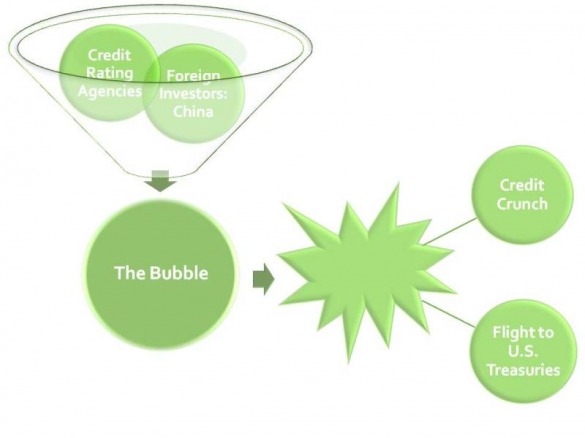

The recent Great Recession had many causes and many results but here we are going to focus on one of the results in particular, "The Flight to U.S. Treasuries". This will give you a better understanding of why this "flight" occurs and just how important the use of these bonds were to investors who were in serious need of ways to reduce the large amount of unexpected systemic risk that was thrown upon them when the housing bubble exploded.

Remember, Safety First...

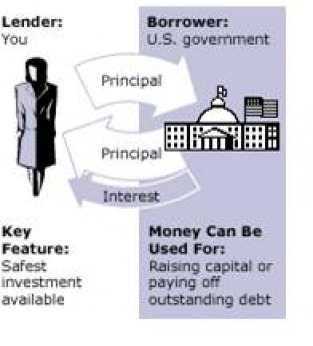

U.S. Treasury bonds have played a central role in global capital markets both at times of tranquility and during crisis. It was in the 1980's that U.S. Treasuries emerged as a global safe haven. During times of financial crisis investors often flock to U.S. government debt to flee from contagion infested markets and to hedge the potentially disastrous risk of their other investments. In tranquil times these U.S. bonds provide a reference point for valuation. There are many reasons for this flight to U.S. Treasuries, but the biggest reason is widespread fear because of a market crash or crisis. This scare leads to an increased demand for safe, income producing assets and U.S. Treasuries are the safest of all.

More Specific Look: Great Recession

During the Great Recession many things happened to spread fear throughout the global economy, but one of the main reasons was due to the enormous Housing Market Burst. There were trillions of dollars globaly invested in Mortgage Backed Securities, so this obviously put a huge strain on portfolios of lots of people and governments around the world. This large amount of risk that then lurked in portfolios everywhere, was counteracted by investors who would then try to hedge against this increased risk. Contagion reduces the benefits of having diversification within your portfolio, and U.S. Treasuries are the only thing that can add diversity when investors need it the most. Another reason for this flight to U.S. Treasuries is the fact that foreign governments/investors see crisis in the U.S. and know there is likely to be low interest rates, which constitute borrowing for cheap from the U.S. That being said, they must also be aware that the interest rates can only stay at a low level for so long, so they must anitcipate them going back up wich would result in a drop in bond prices and more expensive borrowing from the U.S.

Benefits from This "Flight"

Fidelity.com

The two main results from this flight to U.S. Treasuries are liquidity to the U.S. government and diversification to investors. The liquidity that is provided to the government can then be used for paying off outstanding debt obligations or in the case of the Great Recession, bailouts to many large American corporations. Diversity that is provided to investors is crucial, because there is nowhere else to go when crisis hits, investors take on lots of unexpected risk, and they need to balance this risk within their portfolio.

Current Status of U.S. Treasury Bonds

Bondsonline.com

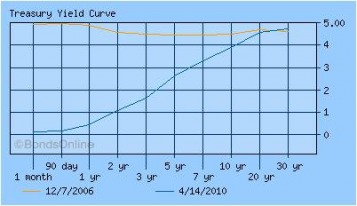

There is currently a strong debate amongst foreign investors about the status of U.S. Debt, particualrly China and Japan. According to Brian Setser and his article, China has recently dumped $34.2 Billion in U.S. Treasuries due to a lack of confidence and bad taste from the Great Recession. This has to be a worry to the U.S. government because they need support from China going forward. Also according to Setser's article, The United Kingdom was the biggest player when China released these bonds onto the market absorbing $24 Billion, along with Japan who took on another $8 Billion worth. Mr. Setser and some experts are also currently saying to hedge against U.S. debt in the anticipation of a default, but this might be a little extreme considering that has never happened. Although, the credit rating agencies have recently threatened to drop U.S. bonds from "AAA" rating to "AA" if they do not reduce their debt obligations significantly in a rather timely manner. The graph here is comparing the combined long/short term Yield Curves for two different snap shots in time. As you can see on the graph from Bondsonline.com, before the the U.S. Government began to perform stimulus actions (and pile up debt) the returns to long term and short term bonds were very close. As time went on and the U.S. engaged in mass amounts of debt, you can see that now the yeilds for short and long term bonds are very different. Bondsonline.com explained that this situation is difficult for investors who hold long term government debt, because they typically tend to benefit from a declining interest rate trend and the interest rate is already as low as it can go. As this curve flattens out eventually, the returns will obviously be similar and investors will not be getting rewarded as much for holding long term bonds. This might be because they think interest rates will decline, which would cause bond prices to rise, hence the benefit of a downward trending interest rate for long term bond holders.