Rating Agencies

Introduction

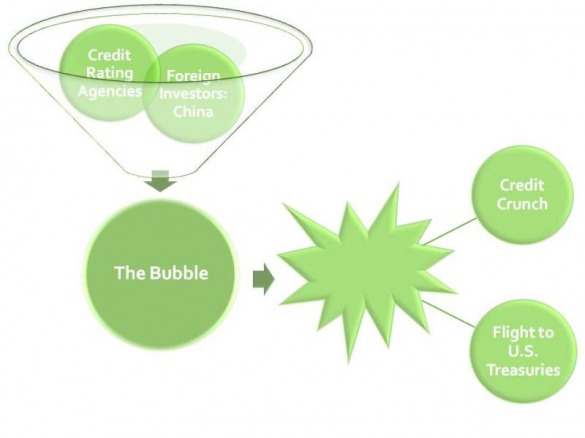

Rating agencies were at the cusp of the recent financial crisis because they had a major conflict of interest with the companies they were rating. The rating agencies have many job, one is to keep stockholders happy the other is to bringing accurate ratings to their customers securities so people can invest with confidence. The agencies failed becuase they fell into this gap of trying to keep their customers happy while not knowing the fundamentals of the securities they were rating. Investors need to stary aware of Rating Agencies and how their being regulated, and how they regulate companies to make sure their taking on the correct risk for the reward.

Rating agencies were at the cusp of the recent financial crisis because they had a major conflict of interest with the companies they were rating. The rating agencies have many job, one is to keep stockholders happy the other is to bringing accurate ratings to their customers securities so people can invest with confidence. The agencies failed becuase they fell into this gap of trying to keep their customers happy while not knowing the fundamentals of the securities they were rating. Investors need to stary aware of Rating Agencies and how their being regulated, and how they regulate companies to make sure their taking on the correct risk for the reward.

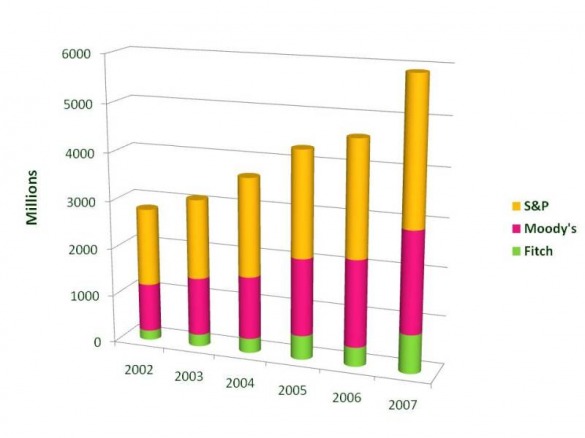

The market for rating securities is dominated by three main players.

· Moody’s

· S&P

· Fitch

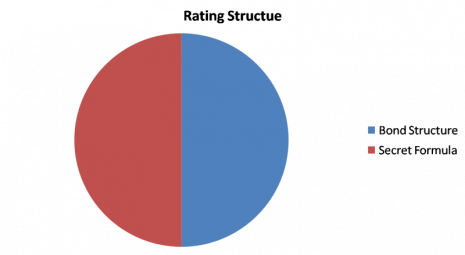

The revenues of the 3 major rating firms are shown in the graph above. As you can see Moody’s and S&P are the two big players and their revenues increased drastically in the time coming up to the recession. The ways in which these companies come up with ratings are by using the same rating structure they use to rate corporate bonds, and a secret formula used to rate the MBS that they started to rate more and more of. One of the main conflicts was faced here because the agencies didn't truly know how to rate these new securities but they didn't want to tell the companies that they couldn't rate them, so they did their best.

· Moody’s

· S&P

· Fitch

The revenues of the 3 major rating firms are shown in the graph above. As you can see Moody’s and S&P are the two big players and their revenues increased drastically in the time coming up to the recession. The ways in which these companies come up with ratings are by using the same rating structure they use to rate corporate bonds, and a secret formula used to rate the MBS that they started to rate more and more of. One of the main conflicts was faced here because the agencies didn't truly know how to rate these new securities but they didn't want to tell the companies that they couldn't rate them, so they did their best.

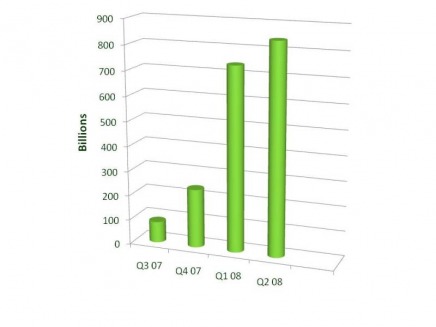

Downgrades

http://v3.moodys.com/productandsolutions/details_/bff961c2-1255-456e-ae07-d7e0f86346e9/prd

This graph show the number of MBS that were downgraded from their previous rating when the news started spreading that maybe these ratings weren't the most accurate. As you can see some people were not very happy when their supposed secure investment could default on them anyday.

The Main Conflict

http://mostlyeconomics.wordpress.com/2009/09/03/history-of-credit-rating-agencies/

The main conflict was that Rating agencies are paid by the companies that their rating so they have an incentive to give them positive ratings so that the company will bring them more business. When you combine their desire to make money and and the fact that they had very little idea at all of what they were rating this was a recipe for disaster.

Future Changes

The SEC is the government entity that regulates the rating agencies and they see major reform and decisive changes coming the rating agencies way. It will take a while for the government to decide what the future holds for these entities and it could take a while to figure out what to do with them. The goal of the government will be to.

- Restore confidence

- transparency

- Full disclosure