Foreign Investors: China

Introduction

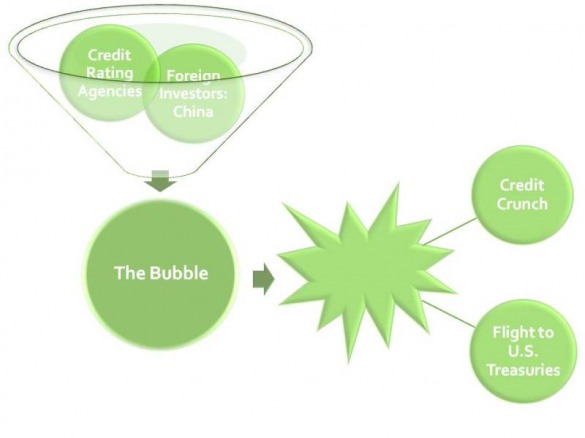

There are several factors that contributed to the creation of the housing bubble and the financial crisis of 2008. Two important factors that led to the creation of the housing bubble include credit rating agencies and foreign investors. Two effects of the financial crisis include the credit crunch and the flight to U.S. treasuries. All of these factors are interconnected. Did foreign investors, such as China, play a significant role in the creation of the housing bubble? I believe that China was a significant factor which helped to create the housing bubble; by investing in large amounts of mortgage backed securities they enabled the U.S. to keep interest rates low and provided lenders with the capacity to lend to qualified and unqualified borrowers.

China as a Foreign Investor: Background Information

- China has bought more than $1 trillion of American debt

- In the past 5 years China has spent nearly 1/7 of its entire economic output on foreign debt (mostly American)

- China recently surpassed Japan as the world's largest holder of overseas treasuries

Did China Finance the Housing Bubble?

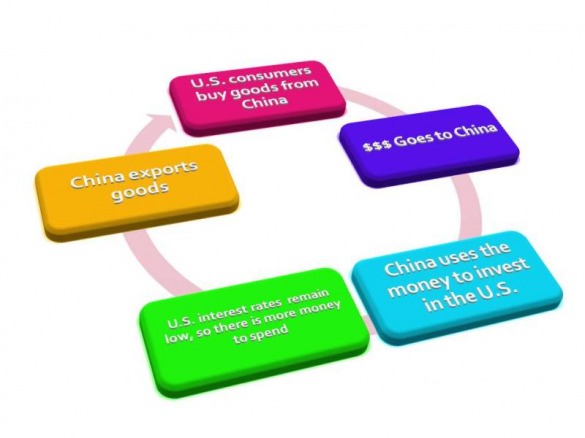

- China's trade Surplus is matched by a trade deficit in the U.S.

- When U.S. consumers buy goods from China, money flows into China

- Then China uses this money for foreign investment

- China invests money in the U.S. causing the supply of loanable funds in the U.S. to increase and allowing interest rates to remain low

China's Trade Surplus

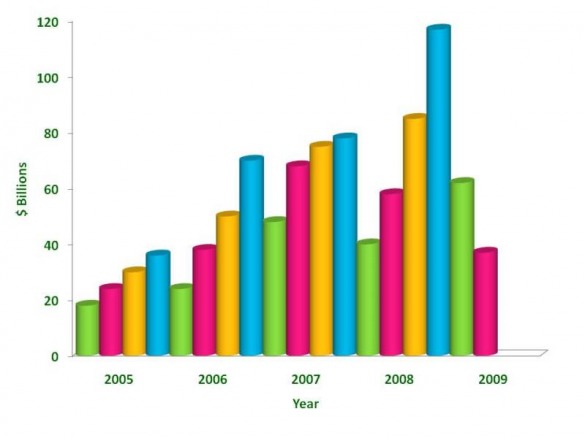

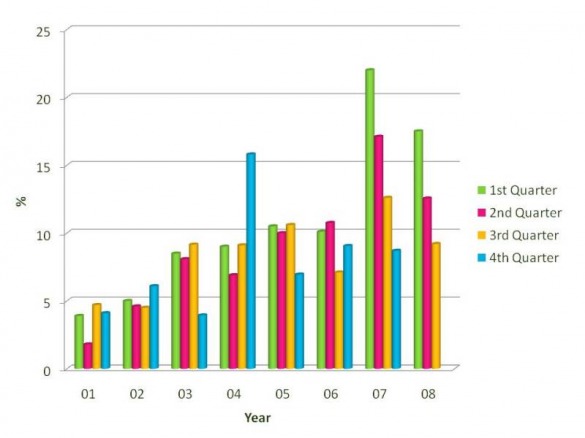

Source: www.forexblog.org/category/central-banks

- China typically carries a large trade surplus

- The graph above shows that China's trade surplus continued to grow larger and larger each year during the housing bubble

- When a country has a large trade surplus, they have a lot of money available for lending and investing

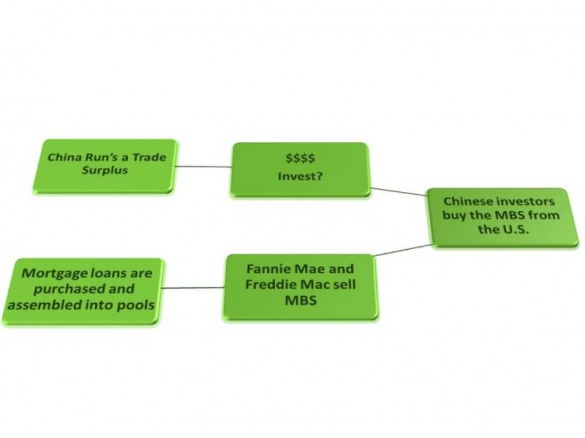

China's Trade Surplus Leads to Investment in the U.S.

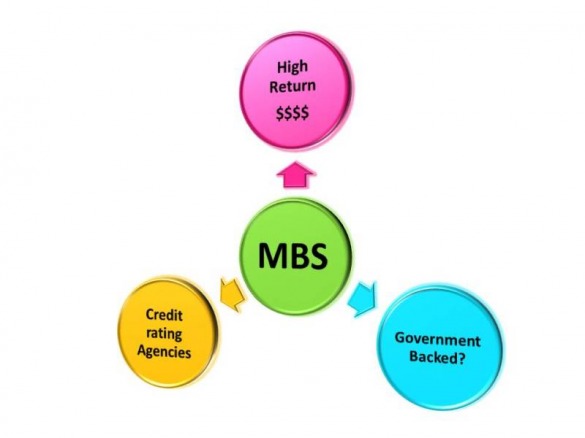

The chart above shows the relationship, between the U.S. and China, which triggered investment in mortgage backed securities (MBS). As you can see in the previous graph, China runs a trade surplus, so they have an abundant supply of foreign currency reserves available for investment. Chinese investors were looking for good investments with high rates of return. Back in the U.S. mortgage loans were being purchased, assembled into pools, and turned into securities. Fannie Mae, Freddie Mac, and other financial institutions issued these MBS. Not only did the credit rating agencies give these securities good ratings, but the ones issued by Fannie Mae and Freddie Mac were implicitly backed by the U.S. government. Therefore, Chinese investors were confident that these securities were safe investments.

Change In Foreign Reserves as a % of China's GDP

Source: http://www.nytimes.com/2009/01/08/business/worldbusiness/08yuan.html

As you can see from the graph above, in 2007 and 2008 China's foreign reserves were a large percentage of their GDP.

Incentives to Buying Mortgage Backed Securities

- MBS offered investors a high rate of return.

- The MBS issued by Government Sponsored Entities, i.e. Fannie Mae and Freddie Mac, were not fully government backed, but it was generally assumed that the U.S. government would step in to offset any losses to investors.

- MBS issued by Ginnie Mae were fully government backed.

- Although MBS included sub-prime loans, the credit rating agencies still gave them good investment grade ratings even when they knew they were risky. MBS often had ratings equal to those of U.S. treasury securities.

- Even though some apparent risk was involved with these securities, China implicitly knew that the U.S. government would back the MBS they purchased.

- All of these incentives combined, persuaded China to invest in MBS.

Why did the U.S. Urge China to Buy MBS?

- During July of 2007 ,there was a surge in defaults by risky borrowers, but the U.S. wanted to tap into the $1.33 trillion of foreign-currency reserves that China had, so the U.S. urged China to ignore any sub-prime woes and to buy more MBS's.

- At this point in time the credit rating agencies downgraded approximately $12 billion worth of U.S. MBS

- China had already invested over $1 billion in U.S. MBS, because they could benefit from these high-yielding investments. This allowed U.S. homeowners to benefit as well, because interest rates remained low, and lenders continued to lend money to unqualified borrowers.

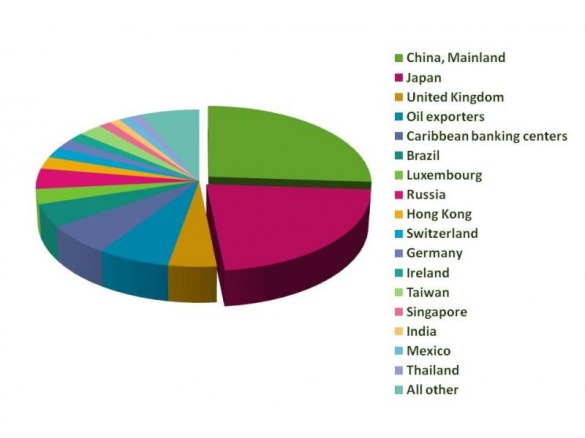

Major Foreign Holders of U.S. Treasury Securities

Source: voices.washingtonpost.com/ezra-klein/2009/06/..

- China also invested in U.S. treasury securities, which provided the U.S. with more money and also helped to keep interest rates low.

- Japan continued investing in U.S. treasury securities and decided not to invest in MBS because they believed that they were not worth the risk.

- As you can see from the pie chart, China holds the biggest chunk, 24%, of U.S. treasury securities and Japan holds approximately 20%.

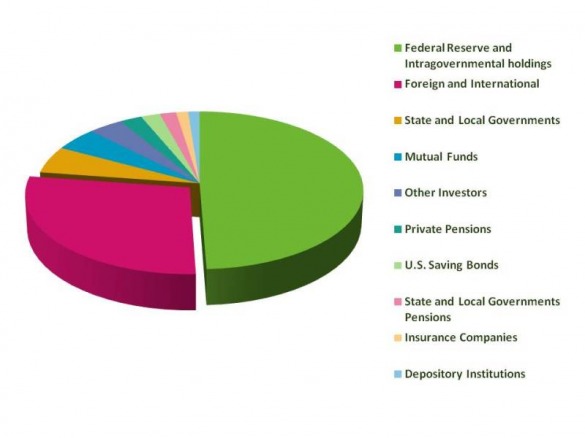

Estimated Ownership of all U.S. Treasury Securities

Source: voices.washingtonpost.com/ezra-klein/2009/06/...

By looking at this chart you can see that foreign investors held approximately 28% of U.S. treasury securities in 2008, which is a big chunk of the pie.

Economic Growth in the U.S.

- Overall, China’s investment in the U.S. was a major contributor to the recent housing bubble.

- The flow of foreign credit and investment stimulated remarkable economic expansion in the U.S.

- It also contributed to lower interest rates, which helped create the housing bubble.

- Financing by foreign investors (the purchase of US Treasury, Agency and MBS) has created a surplus of funds allowing U.S. consumers to spend more money than they actually have.

- Americans became accustomed to living beyond their means. Hence, all of the sub-prime loans that were made during the housing bubble.

- People were basically buying houses that they could not afford, and would eventually default on. The large number of mortgage defaults eventually led to the credit crunch and the flight to U.S. treasuries.

Page and illustrations created by: Brittany Cornum