The Credit Crunch

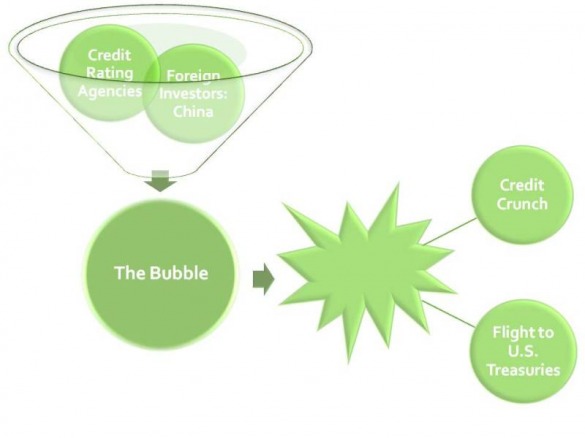

The Credit Crunch refers to the reluctance of investors to risk capital through investment, reluctance in lending by banks and other financial institutions resulting in unavailability of mortgages, especially sub-prime mortgages, and sharp increase in interest rates on loans and decline on interest earned through savings. Another factor to consider in determining credit crunch characteristics is demand for loans and credit. If demand for these loans, mortgages, and credit is low, you may not have a credit crunch. High demand for unavailable low-interest loans and credit is characteristic of a credit crunch. Also, an overall lack of lender and investor confidence throughout the economy in numerous sectors and high rates of unemployment throughout many sectors as well. The credit crunch is one of the main consequences of the 'Great Recession' due to three main factors:

- Collapse of the Housing Bubble

- Failure of financial institutions

- Lowered investor confidence

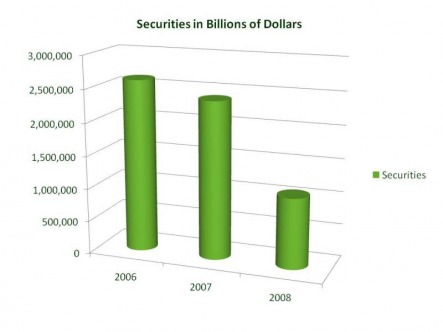

Issuing of Securities 2006-2008

http://www.federalreserve.gov/econresdata/default.htm

Issuing of Corporation stocks, bonds, debt, etc in billions of dollars. reaches a peak in 2006, then begins to decline at the beginning of the recession. In 2008 the number dropped to less than half of the amount in the previous year of 2007.

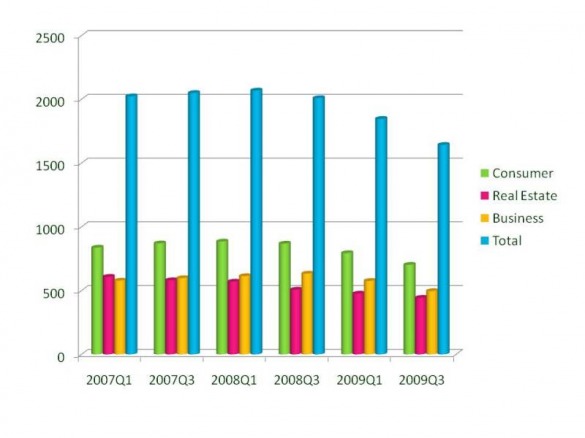

U.S. Financing 2007-2009

http://www.federalreserve.gov/econresdata/default.htm

Financing in the U.S. in the years of the onset of the credit crunch shows the substantial decrease in lender confidence since the beginning of 2008. The third quarter of 2008 shows the first significant drop due mainly to the large fall in real estate financing. The quarters of 2009 show the huge decreases that are due to drops in all three categories for financing and by the third quarter of 2009, financing in the U.S. had decreased by nearly $500 billion from what it was just 18 months prior.

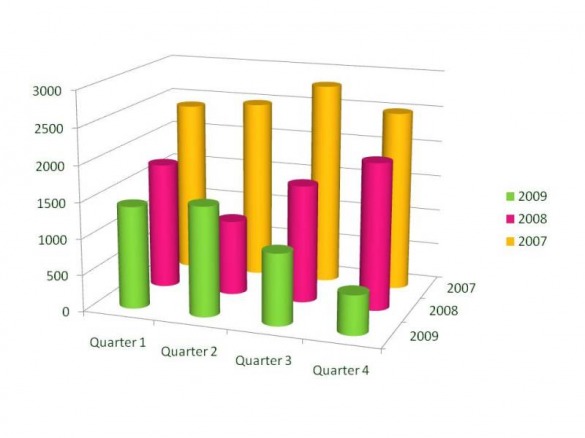

Borrowing in the U.S. 2007-2009 (In Billions)

http://www.federalreserve.gov/econresdata/default.htm

Borrowing in the U.S. during the years of 2007 through 2009 represent the damaged investor confidence throughout the country after the credit crunch took hold. Again the third quarter of 2007 shows the highest point of the three years, with major decreases in the second quarter of 2008 along with the third and fourth quarters of 2009.

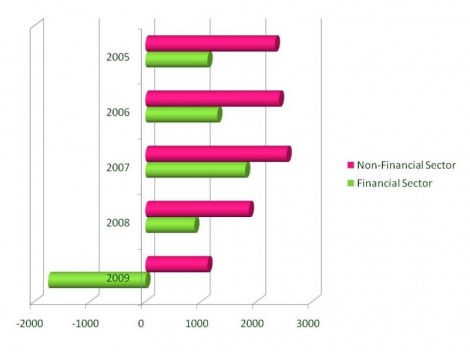

Net Borrowing and Lending 2005-2009

http://www.federalreserve.gov/econresdata/default.htm

This graph breaks down the decreases in U.S. borrowing and lending by sector in billions of dollars to point out the enormous decreases in 2008 and 2009 by both non-financial and financial. However mainly this shows the incredible drop in financial sector borrowing and lending in the year of 2009. This is clear evidence of the intense reluctance and skepticism in the U.S. economy, especially within the financial sector.